1s retail everything goes to collection. External processing

Send this article to my mail

How in 1C Retail 2.2 to transfer funds (hereinafter referred to as DS) from the cash register, into which they enter when retail, and capitalize in the operating cash desk of the company? If you are interested in this question, then this article is just for you.

The withdrawal of money in 1C can be performed both during direct work in the RCC without completing the cash register shift, and upon completion of work and closing of the current work shift.

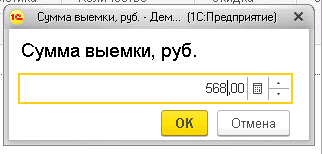

In the first case, when you press the Withdraw money button, you must manually specify the amount to be withdrawn from KKM cash desks. A form for entering the amount of withdrawn money will appear on the screen. Enter the amount and press Enter.

Please note that withdrawing money in 1C is possible only if there is a connection to a fiscal registrar or other receipt printing device. Otherwise, the system will generate an error.

In the second case, the withdrawal is performed by pressing the Close shift key.

Please leave the topics you are interested in in the comments so that our experts can analyze them in articles-instructions and in video instructions.

Depending on the system settings, the following options are possible: either the entire amount stored in the cash register of the cash register will be automatically withdrawn, or you will be prompted to manually specify the withdrawal amount, or the withdrawal will not be made at all.

Here we digress to the system settings. The rules for carrying out the withdrawal of the DS are set in the information register Cash discipline of the withdrawal at the closing of the shift. You can open it from the store or organization card by clicking the Go icon.

The following options are configured here:

Perform a complete excavation. Then, when you press the Close shift key, the entire current balance of funds will be automatically considered withdrawn from the cash register.

Allow partial withdrawals with a maximum remaining amount. When closing the cash register, the system will prompt you to specify the amount of cash withdrawal, the remaining cash registers will be stored at the cash desk. If the balance amount exceeds the maximum value, then when performing the shift closing operation, the system will issue a warning with the option to correct the previously specified withdrawal amount or to withdraw later. The same control is also established for the manual withdrawal of money during the work of a cashier in the RCC.

Do not take out.

If there is no setting for the organization and the store, then when the shift is closed, the machine will automatically reflect the complete withdrawal of money from the cash register.

As a result, the system will create a cash withdrawal document that reflects the transfer of money to the store's cash desk.

So there is no more cash in KKM, but they have not yet arrived at the operating cash desk. We can check this information using the Cash on hand report (section Finance - Financial reports).

In order for the DS to enter the operating cash desk of the company, it will be necessary to take them there. You can do this in a special workplace Cash receipt orders (section Finance). First, open the second tab, it reflects orders for the acceptance of DS and, accordingly, seizure documents fall into this list. When you click the Accept payment command, an incoming cash order is generated and the money is credited to the cash desk.

On the first tab of this workplace, there are already generated documents for posting the DS.

Just as one individual brick in a wall does not greatly affect the strength of the entire building, so keeping a cash register in a store does not in itself give you any clear global advantages. If the brick is pulled out, the wall will not collapse.

Cash desk is such a small brick. One of many. In itself, insignificant and completely uninteresting. But together with others, he creates a coherent, working system.

It is impossible to build a building without bricks.

For example, the main condition for maintaining balances of goods in 1C is that all real movements of goods are accurately reflected in the program.

One of these movements is sales per day. If the cashier did everything correctly, then the Retail Sales Report document should contain a list of all goods sold per shift. But how can you be sure that everything is entered correctly?

One of the options is to require the cashier to compare the amount of sales on the computer with the revenue actually received for the shift. How does the cashier fulfill this requirement? At best, it looks at the total amount of the document that appears on the screen when the shift is closed.

It is possible to work without a cash register, but accounting will not be complete and complete.

The amount of this document must be reconciled with the amount of cash on hand. But in it, in addition to cash receipts, payment is also reflected. bank cards, bonuses or gift certificates. The balance in the cash register also rarely coincides with the proceeds received per day - there are balances from the previous day, and receipts of change money, and cash withdrawals to the central office. Those. to fulfill your requirement, the cashier needs to make an effort. Considering that everything happens at the end of the shift, when you already want to run home as soon as possible, the cashier in the end does not check anything at all.

This leads to the fact that sales are not verified at all and, for various reasons, differ from the real ones. Which contributes its small share of deviations to the inventory results.

Keeping a cash register is just the lever that can make a cashier check documents normally in the program. You require from the cashier only that the amount of cash in the cash register coincides with the amount of the balance in the cash register report.

Report example

Abbreviations and terms

Before proceeding to the description of working with the program, familiarize yourself with the terms that are used there:

- DC- cash

- Article DDS- cash flow item.

- Used for reports: "Cash flow", "Daily report of the cashier"

- Cost item

- Used for grouping in cost reports: "Costs", "Working capital structure"

- The differences between a cost item and a VAT item are described below.

- RKO- account cash warrant

- PKO- incoming cash order

The difference between a cost item and a VAT item

- Not all DC movements are costs

- For example, “Movement of DS”, “Making an exchange”, “Delivery of proceeds to the office” are reflected in the report on movements, but are not costs.

- Not all cost items are DC movements.

- For example, if we take into account the cost of wages on an accrual basis, then the fact of expenses is recorded at the time of accrual (which is made at the end of the month), and not the payment of money (which is made at the beginning of the next). Those. when accruing, there are costs, but there are no DS movements.

- Payment to the supplier for the goods is not considered a cost, because this amount will be taken into account when calculating the margin from the sale.

- The write-off of marriage or shortages for the audit is an expense, but there are no cash flows.

Reflection of specific operations

Keeping a cash register does not provide clear advantages - it is a small brick in the wall of your house. If the brick is pulled out, the wall will not collapse. But you can't build a house without bricks. Work without taking into account the cash register is possible, but accounting will not be holistic and complete.

Retail revenue

- This is the amount of cash received from retail trade.

- Cash register movements are created automatically when posting the Retail Sales Report document. In the report on movements, it is reflected under the item of VAT "Retail revenue"

Seizure of DS (collection)

- At the end of the day, the amount is withdrawn from the cash desk and transferred to the central office or bank.

- Depending on what happens to the money next, you need to do the following:

- If the money is transferred to the cash desk, which is also kept records

- Make a document "Internal movement of DS"

- Sender - "Shop", recipient - "central cash desk"

- The money will be debited from the cash register of the store, credited to the cashier of the recipient

- If the money is not taken into account further (for example, the balances in the cash register of the store are maintained, but the balances of the entrepreneur's money are not maintained)

- It is necessary to make a cash settlement with the type "Other cash flow"

- Select the article of the movement "Rented to the office" (create it yourself)

- If the money is deposited in the bank

- Make RKO

- Transaction type - "Cash deposit to the bank"

- Select the current account to which the money will be credited

- Select the relevant DDS article

Entering the cashier for exchange

- It is carried out in the same way as cash collection, but instead of cash settlement, it does PKO.

Payment to the supplier

- Make cash register with the type "Payment to the supplier"

- In the "Comment" field, describe what the money was given for

Receiving payment from the buyer

- It is carried out only if the buyer received the goods according to the document "Sale of goods and services".

- Make a PKO with the type "Payment from the buyer" (you can enter based on the implementation)

- In the "Contractor" field, select a supplier

- In the "Comment" field, describe what the money was received for

Reflection of cash shortage

- A shortage occurs if the amount of cash on hand is less than the balance on the report. Often, for example, there are deviations of insignificant amounts from incorrectly issued change.

- It is necessary to make an RKO document (if there is a shortage) or PKO (if there is a surplus)

- If this amount is refunded by the seller

- select the type of transaction "Payment to the supplier"

- select a seller as a counterparty

- DDS article - cash register shortage

- the amount of shortages for the month can be seen in the report "Movement DS"

- If the debt is not assigned to the seller, but is reflected as other costs

- select the type of operation "Other expenses"

- select the article DDS - "cash shortage"

- select a cost item - "cash shortage"

- the amount of shortages for the month can be seen in the report "Costs"

- If this amount is refunded by the seller

Other small expenses (water, stationery, etc.)

- Type of operation - other expense DS

- The field "Article of the movement of the DS" - select the type of movement (water, rent, salary)

- Field "Cost item" - select the same, only from the costs (water, rent, salary)

- The field "Article of the movement of the DS" - select the type of movement (water, rent, salary)

Checkout reports

Store balance management begins by requiring salespeople to print out a Cashier's Daily Statement daily, which must match the actual cash on hand. This will oblige them to be attentive to the checkout and register all movements on it. To do this, they need to enter only two types of documents:

- RKO when issuing money from the cash desk

- PKO - upon receipt of money (exchange or from the buyer)

- This report is ours, which can be connected to your program. Contact us to get it.

- The report serves as a replacement for the cash journal, which you may still keep manually.

- Menu item: "Reports / Cash/ Statement of cash

- For each cash register, it shows income, expenditure, initial and final balance of den. funds.

- Like any other standard 1C report, it can be displayed in various forms, depending on the settings (grouping of rows and columns, selection, indicators can be changed)

- Menu item: "Reports / Cash / Cash Flows"

- Shows the movement of money by items for the selected period.

- The report can also be brought to any form you need using the settings

Withdrawal of money from the cash desk can be carried out not only at the end of the day, but also during the working day.

In the open cashier's RMK in the upper right corner, press the button MORE - Seizure of money.

Specify the amount you plan to withdraw and click OK.

The fiscal registrar prints the appropriate document - check on withdrawal of funds.

If the shift needs to be closed, in the open RMK in the menu More press the button Close shift.

At this point, a blanking report (Z-report) is printed and a document is formed. Retail sales report. It is divided into tabs:

Goods and services- reflects all positions sold during the shift;

Payment by cards- all transactions in the context of cards and amounts.

We carry out the document and close it.

The money has been seized, but in fact they are still in the cash register of the store. It is necessary to carry out the transfer to the central (main) cash desk of the company.

Chapter Money-banks and cash desk.

The line with the name of the central (main) cash desk of the enterprise is automatically filled in the receipt document.

The amount is set manually. In field Payment decryption you need to specify the KKM cash desk, from which we transfer money to the main cash desk.

The document must be posted and closed. The extraction has been made. You can control the movement of funds using reports. Chapter Money- Reports

The simplest is the report Money movement. Enter the desired date and click the button Form. As you can see, the transfer of money to the main cash register has been made.

It was told about registration in the program "1C: Trade Management" edition 11.3 of retail sales through an automated outlet with a connected fiscal registrar.

Today you will learn how to register the transfer of retail proceeds to the company's cash desk for ATT.

Unlike sales through NTT (manual point of sale), when selling through ATT, the transfer of revenue occurs in two stages:

- Seizure of money from the box of the cash register (KKM);

- Registration of a cash receipt order for the receipt of money in the cash desk of the organization.

Let's consider in more detail.

Withdrawing money from cash register

Suppose in our automated point of sale sales were made, then the cash register shift was closed, the proceeds are in the box of the cash register.

To register in 1C the withdrawal of money from KKM, let's go to the register of KKM checks.

Sales / Retail sales/ KKM checks

The status is displayed at the bottom of the log checkout shift and the amount at the cash desk of KKM:

Click on the "Cash out" button. In the window that opens, enter the amount to be withdrawn, then click OK.

The program recorded the withdrawal of funds from the KKM cash desk. If you now update information about the status of the shift, then the amount of money in the cash register will decrease.

Statement of cash. Cash on the way

The withdrawal from the cash register has been completed, but the money has not yet been transferred to the cash desk of the enterprise. This amount is treated as "cash in transit" in the program.

Open the Cash Statement report.

Treasury / Treasury reports / Statement of cash

Let's create this report for our organization.

We remind you that by default reports are generated in the currency management accounting, in our example - in US dollars. “Cash in transit” is displayed in a separate subgroup.

Incoming cash voucher for receipt of retail proceeds

The presence of funds in transit (after the withdrawal of retail proceeds from the KKM cash desk) is the basis for entering the cash desk of the enterprise. Therefore, in this case, it is better to create an incoming cash order not manually, but automatically, using the “To Receipt” page.

Let's open the PKO magazine.

Treasury / Cash desk / Incoming cash order

In the journal, go to the "To Admission" tab. Here is a list of orders for the receipt of cash at the cash desk.

Advice. To simplify the search by orders, you can set the selection in the field "Payment reason"

Specify the reason for the payment - "Cash in transit". The order we needed to receive money from the KKM cash desk was displayed. Select it and click "Finish".

A new document "Incoming cash order" with the operation type "Receipt from another cash desk" has been created. In it, on the “Basic” tab, the amount and the sending cash desk (fiscal registrar) are already filled in. In the "Cashier" field, you must specify the cash desk of the enterprise, into which the money is received.

Important. In order to display all the necessary data when printing a cash order, do not forget to fill in the details on the "Print" tab.

After filling, we will draw and close the document.

If we now reformat the report "Statement of cash", it will display the write-off of money from the subsection "Cash in transit" and their receipt in the cash desk of the enterprise.

Read our article on calculating profit from retail sales.